Let us know what type of content you'd like to see more of. Fill out our three question survey.

What Job Postings from Mexico's Energy Sector Reveal About the State of Clean Energy

Jun 24, 2021

A significant challenge to achieving the Sustainable Development Goals has been measuring country progress in the transition to renewable and clean energy sources. While expert surveys or legislation enacted may provide some insight into how countries are progressing on the whole, they lack the granularity to inform us about subnational trends, skills in-demand, and the presence of firms and subsectors within each country.

One useful way to explore these factors is by analyzing data available from job search engines and using keywords related to the energy sector. These can provide insights on how jobs in key sectors and subsectors evolve over time, what the demand for labor among firms in the energy sector is, where these openings and firms are located, and how they differ in terms of skills sought in the labor market.

For the Mexico Energy Programme, funded by the Foreign, Commonwealth & Development Office (FCDO), we have collected data from several job search engines since August 2020, with the objective of examining employment trends and skills demanded by firms in the traditional and clean energy subsectors across time and regions. Below, we provide an overview of differences in two key sectors: the traditional oil and energy sector and the renewables and environment sector. We examine the longitudinal trends, regional differences, the key functions, skills, and responsibilities sought within each of these sectors and analyze these parallel sectors within Mexico.

This post is the first in a series. It establishes a baseline from which we can assess the evolution of clean energy in the Mexican economy. In the following posts, we will further explore insights that data on job postings from job search engines can provide while highlighting the advantages and limitations of using this data relative to other sources.

Longitudinal Trends

From August 2020 to February 2021, employers have advertised 6,238 jobs in the energy sector based on keyword searches. This data suggests that 67 percent of these jobs are in the oil and energy sector. In terms of the relative dominance of oil and energy compared to the renewables and environment sector, we find several important underlying reasons. Mexico is a net importer of energy with a high degree of dependence on fossil fuels, which represent 87 percent of the energy produced and 90 percent of the energy required. Nuclear power and renewable energy compensate for this gap, with renewables representing 10.4 percent of primary energy production in Mexico.

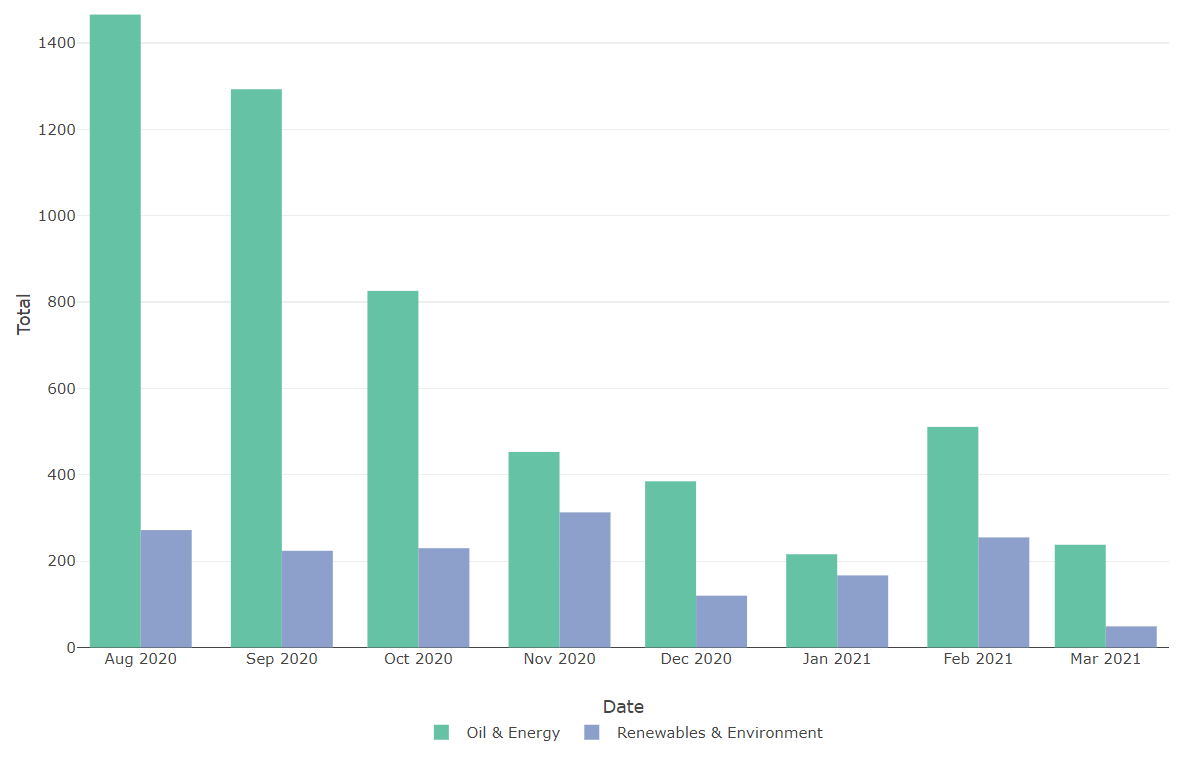

First, the initial points in our data suggest that the oil and energy sector varies heavily across time. These changes may be seasonality effects, in which certain periods are more opportune for work, surge due to government approval of contracts for exploration or production of natural resources in certain regions, or both.

Total Number of Jobs by Sector by Month (Source: EPI Dashboard).

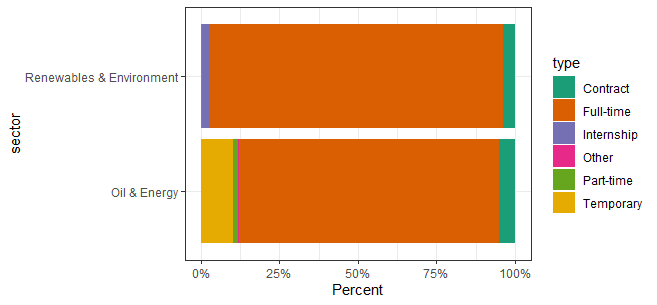

Digging deeper into the data also suggests that the oil and energy sector has a significantly higher number of jobs that are not full-time: 19 percent of jobs in the oil and energy sector are temporary, contractual, or part-time, compared to 4.5 percent in renewables and environment. Such a high proportion of these types of jobs in this sector suggests that employment is heavily project-driven and dependent on value chain specialization, with a high number of temporary jobs relating to midstream purposes such as transportation and distribution of natural resources.

Proportion of Jobs Disaggregated by Contract Type by Sector (Source: EPI Dashboard).

Renewable Energy Job Trends

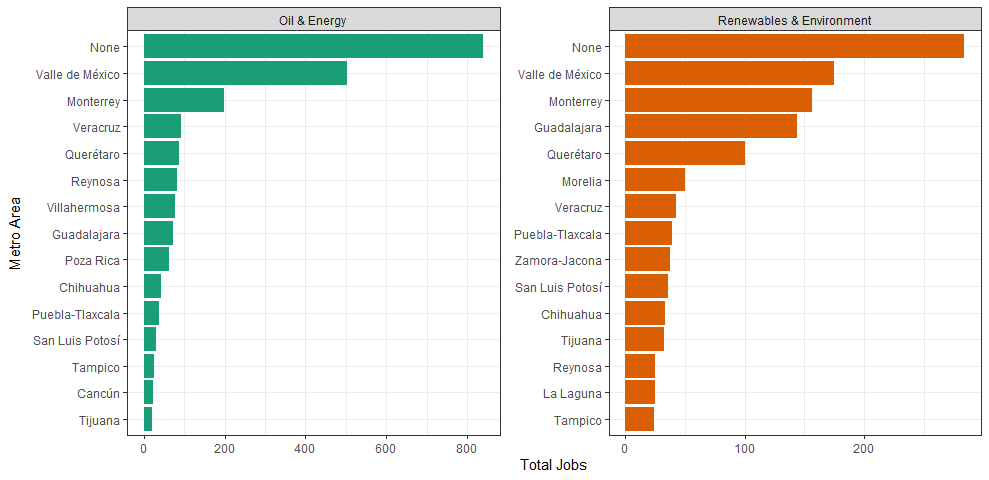

Unsurprisingly, Mexico City constitutes a huge portion of the labor market in both sectors, but this masks several important differences between the two. As a starting point, the renewables and environment sector has a much higher proportion of jobs in major cities and metropolitan areas, with relatively more jobs in the second- and third-largest metro areas such as Guadalajara and Monterrey, and other secondary cities such as Queretaro, San Luis Potosi, Puebla-Tlaxcala, Morelia, and others. Further to this point, 39 percent of jobs in the renewables and environment sector are in the 20 largest municipalities by population, compared to 20 percent of jobs in the oil and energy sector.

The higher proportion of non-full-time jobs in the oil and energy sector also fits with this regional trend: a significant amount of jobs in the oil and energy sector are either tied to exploration sites for onshore and offshore drilling, logistics, and transportation of natural resources, and other factors. These are usually outside of the major cities. While there are jobs in the renewables and environment sector outside of the major cities, such as maintenance of solar panels or wind turbines, these represent a significantly smaller portion of jobs.

Total Number of Jobs in Metropolitan Areas by Sector (Source: EPI Dashboard).

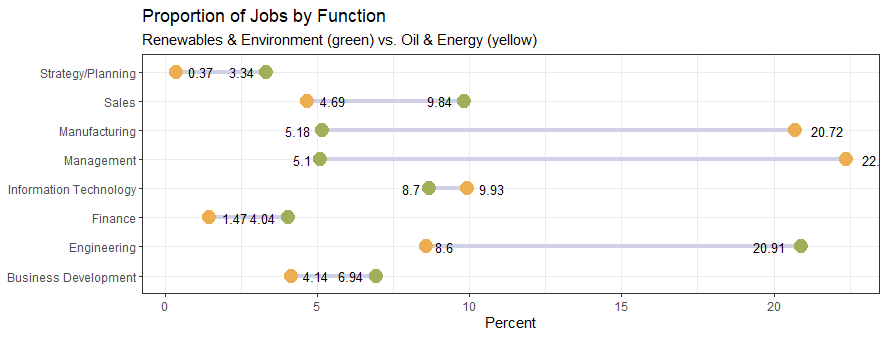

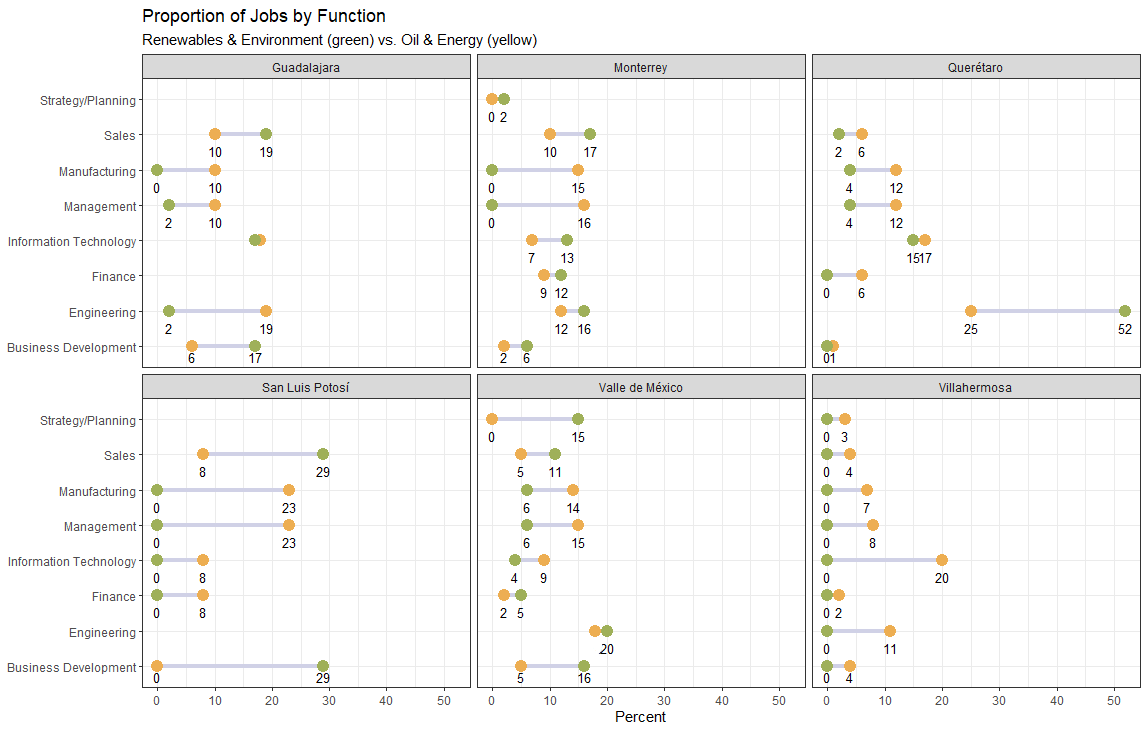

Thus far, the data has shown very little about the nature of these jobs. What exactly are the functions and responsibilities of jobs in each sector? Information using data from LinkedIn provides some insight on this. Looking at the function tag of job postings, we can see that a large number of jobs in the oil and gas sector relate to natural resource production activities that fall into the manufacturing and management functions. These are jobs that typically require a high school level of education and are frequently outside of major metropolitan areas whose focus relates to the day-to-day operations of drilling, operation of wells, transportation and logistics, and refinery operations.

In turn, these jobs do not exist in the same quantity in the renewables and environment sector, where a higher proportion of the job functions are desk jobs that require undergraduate and graduate-level education. Although there are maintenance and installation jobs in these industries, value chains in the renewable energy sector are still emerging and do not yet have labor supply.

It is important to note that proportions only tell part of the story—the 0il and energy sector is a larger sector overall and therefore has more in absolute numbers for all of these function types indicated in the graph below. Thus, although engineering jobs may represent a higher proportion of jobs in the renewables and environment sector, there are more engineering jobs overall in the oil and energy sector in this timeframe, 854 compared to 238 in renewables and environment. In making these comparisons, the story is more the sheer volume of other job functions that are sought after in the oil and energy labor market, particularly in manufacturing. As clean energy develops to a larger scale in Mexico and there are more solar and wind plants present, it is expected that demand for jobs in the sector requiring these functions will increase. Therefore, as the sector continues to develop in Mexico, continued monitoring of the generation of jobs beyond business-related and engineering functions will provide indications of its overall presence in the country.

Proportion of Jobs by Function (Source: EPI Dashboard).

What can this data on job function tell us about the regional differences previously highlighted? When disaggregated by metro area, the proportions become a bit noisier and harder to interpret. What tends to stick out is that outside of the Valle de Mexico metro region, job functions tend to be focalized in one specific area in each given metro area in both sectors. Therefore, we see engineering jobs in the renewables sector dominate in Queretaro, while in San Luis Potosi and Guadalajara the jobs tend to be in business development and sales. This also shows up in the data in the oil and energy sector: information technology jobs are prevalent in Villahermosa, while manufacturing and management jobs are more common in San Luis Potosi. This may be due to the dominance of one firm or a cluster of firms in each industry that seek employees with these skillsets.

Proportion of Jobs by Function (Source: EPI Dashboard).

Parallel Industries

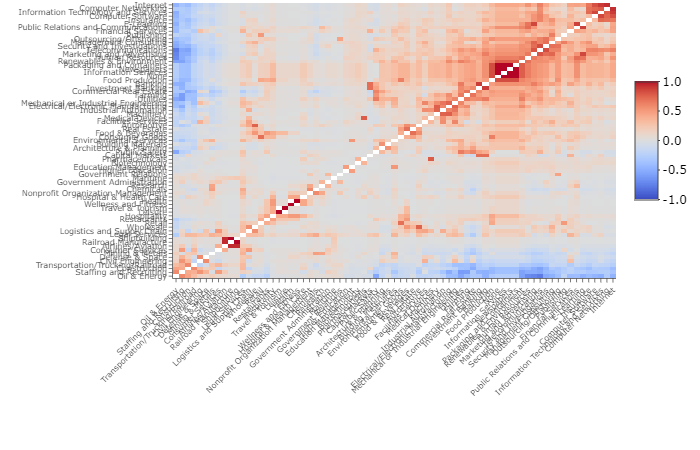

Another form in which we can deepen our understanding of the nature of jobs in the energy sector is seeing other sectors that are closely related. Given that several job search engines such as LinkedIn use multi-classification tags for job postings, we can exploit these to examine the association between key parallel sectors of the energy sectors and explore how value chains are connected across Mexico’s economy.

Heatmap - Correlation of Sectors (Source: EPI Dashboard).

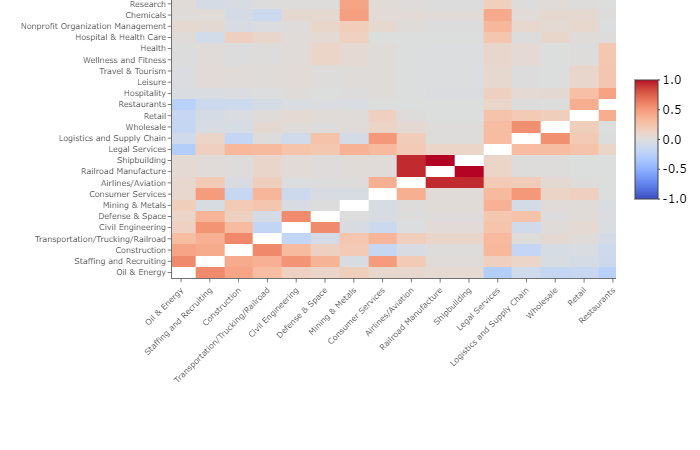

We find that the most common tags used together with the oil and energy sector are staffing and recruiting, construction, and transportation/trucking/railroad. Regarding the first, this is mostly due to the high number of headhunters and recruiters seeking employers in the extractives industries. The latter two, however, tell us about the nature of jobs that appear in the oil and energy sector: midstream jobs related to the distribution and transportation of oil and natural resources make up a significant number of jobs in the energy sector in Mexico. The parallel relationship between oil and energy and construction can be explained by the high volume of jobs that entail physical labor of construction, such as building well foundations, setting up rigs, welding pipelines, and building refinery infrastructure.

Heatmap: Correlation of Sectors – Oil & Energy (Source: EPI Dashboard).

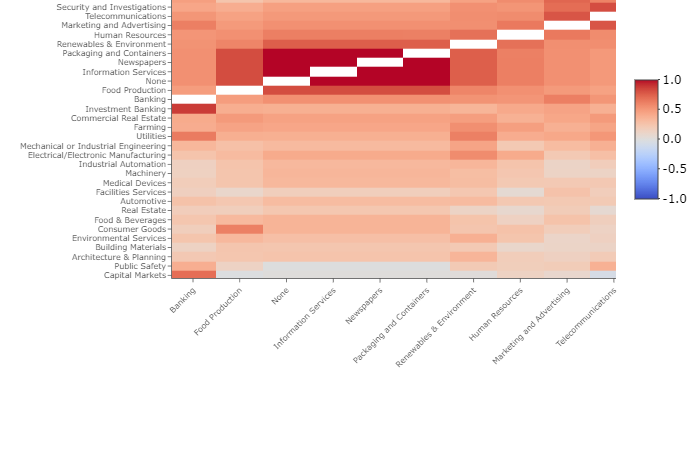

The renewables and environment sector has many parallel industries, as represented by the large red cluster in the upper-right corner of the heatmap. When zooming in, we find a significant association between the renewables and environment sector and the following industries: packaging and containers, information services, and newspapers in one part of the graph, and electrical/electronic manufacturing, industrial automation, mechanical and industrial engineering, and utilities in another part of the graph. Similar to the oil and energy sector, a story can be told about the areas in which clean energy is having its greatest impact: the creation of energy-efficient products and automobiles and the development of alternative sources of electricity for households such as solar and wind.

Heatmap: Correlation of Sectors – Renewables & Environment (Source: EPI Dashboard).

Key Takeaways

In conclusion, the analysis highlighted above brings together three key findings. First, much like other countries and particularly those starting their transitions to clean energy sources, the traditional energy sources of oil and other natural resources continue to dominate the labor market in Mexico when compared to renewables and clean energy sources. In particular, seasonality effects and non-full-time labor are key drivers in producing a larger quantity of jobs in oil and energy. These also show up in understanding the regional dimension of these jobs: a relatively higher number of jobs in the oil and energy sector are located outside of the major metropolitan areas.

On the other hand, jobs in the renewables and environment sector tend to appear in major cities with higher levels of human development and education levels. In terms of the key functions within each sector, we see that the oil and energy sector produces relatively more jobs that require physical labor, focused on manufacturing and management functions, while in the renewables and environment sector we see that engineering and business-related jobs make up a significant portion of the jobs.

These insights have allowed us to gain a baseline understanding of the state of clean and traditional energy sources in Mexico. It is also important to note the limitations, as these job postings leave out to some extent the important role that public sector jobs and smaller firms play in the energy sector as well. Combining this with other sources of data and other measures will help provide a larger picture of where countries stand in these areas. Given the increased focus on low- and middle-income countries in the green energy revolution, examining job postings provides us with an important perspective of the energy sector from a longitudinal, regional, and skills-based perspective.