Let us know what type of content you'd like to see more of. Fill out our three question survey.

How Digital Climate Risk Assessment Tools Help Unclog Climate Finance Flows in Emerging Economies

Jul 19, 2021

Traditional lending channels are blocking access to climate finance. The large commercial banks that receive funds from investment banks accredited by the Green Climate Fund typically seek smaller financial institutions in local markets to distribute these funds. However, these smaller institutions often lack the tools needed to appraise risk and begin lending, meaning that funds that have been allocated towards climate mitigation, resilience building, and adaptation efforts are not being efficiently disseminated.

As part of the InterAmerican Development Bank’s EcoMicro portfolio of climate mitigation and adaptation programs, supported through a partnership with the Government of Canada, DAI has designed a digital Climate Tool for Assessing Risk and Preparedness (Climate TARP), an app designed to provide a balanced approach to risk and preparedness analysis, and help lenders assess the levels of vulnerability in their loan portfolio and from three different perspectives:

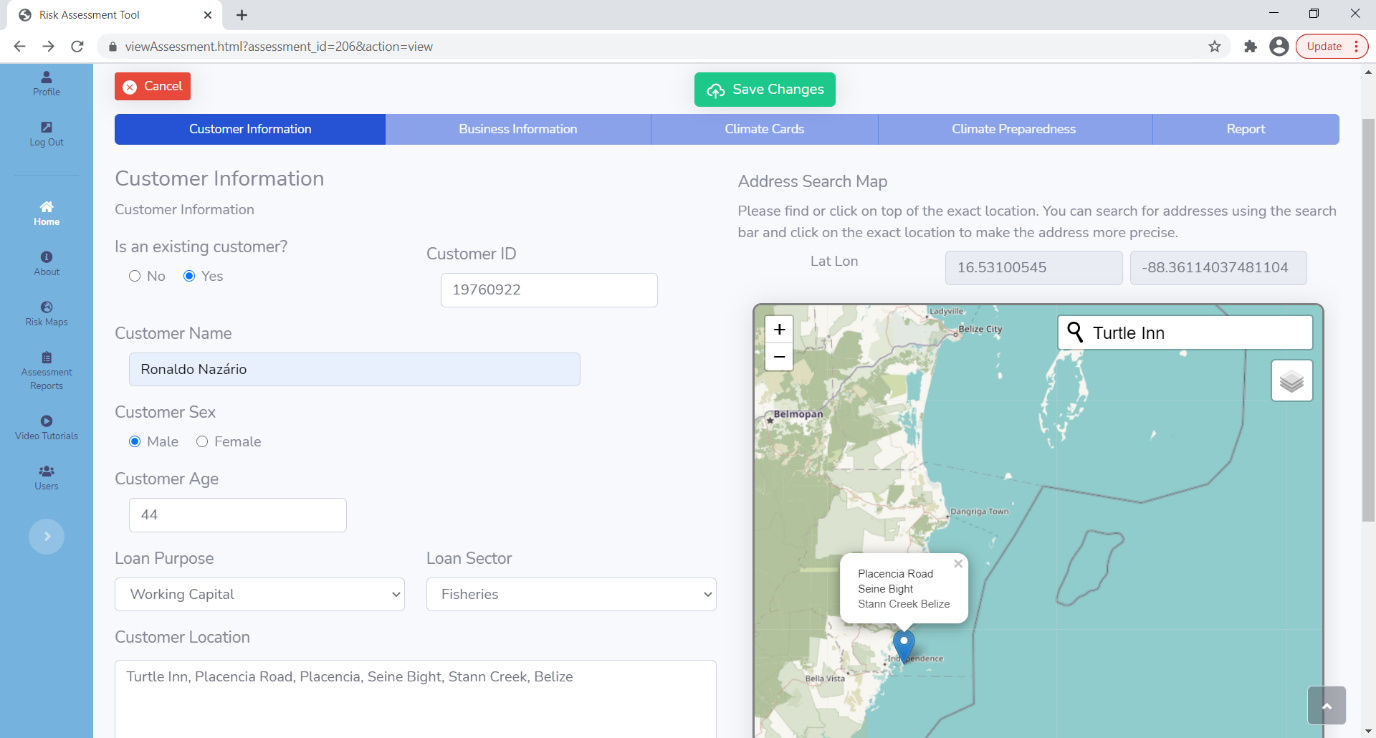

- Applicant information and the investment portfolio assignment: Using Climate TARP to develop a customized climate risk and preparedness assessment is a simple process. The first stage is focused on information collection (see below). Key information about the loan applicant is collected—including their geolocation, their business, the sector in which they operate, and any additional information typically required for a loan application.

Business information layout using Climate TARP.

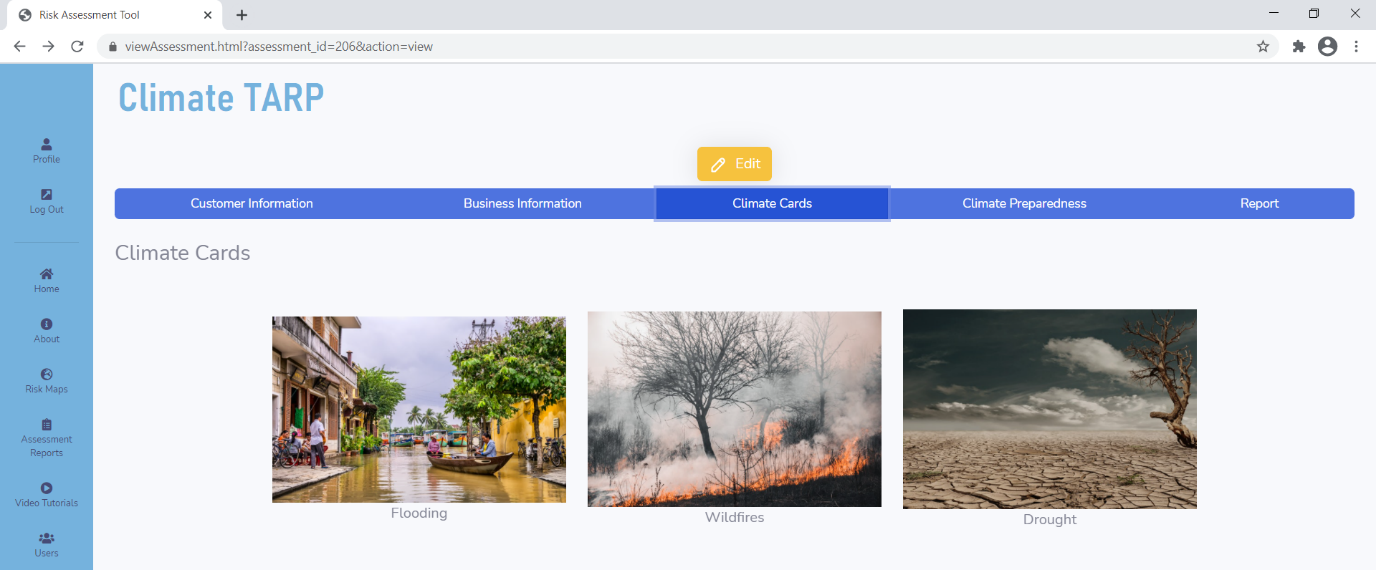

- Geolocation of the business and the probability of a damaging climate event: Based on the geographic and sector-related information provided to the assessor, Climate TARP generates Climate Cards (pictured below), which highlight some of the historical climate risks the applicant may experience, along with GIS-powered risk maps. These Climate Cards inform the climate risk analysis and help focus the assessment on a set of questions that evaluate the client’s climate preparedness for each potential risk.

Climate Cards available for the specific customer.

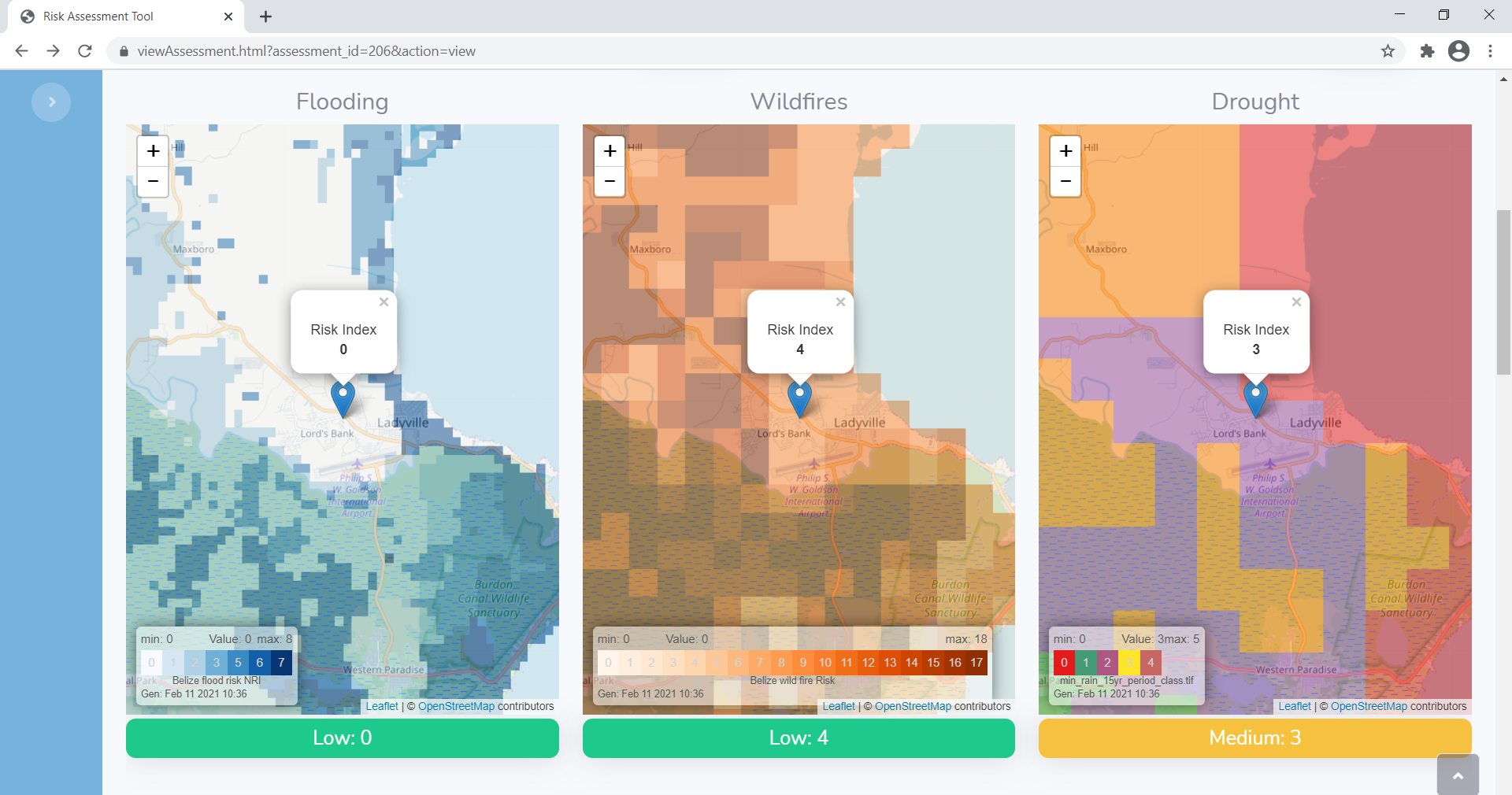

- Client’s ability to adopt climate adaptation technologies and techniques: Climate change is not a new concept for loan applicants, many of whom have already taken actions to adapt to climate variability and change. Climate TARP offers credit institutions the option to acknowledge these actions when assessing risk and resilience. The report that is generated by the assessment presents clear risk profiles with compelling visual elements that illustrate both climate risk and context (partially pictured below). An overall climate risk rating of low, medium, high is the key decision-making output and is calculated numerically through a weighted scoring of business information, climate information, and customer preparedness. The report also provides a simple breakdown of the ratings.

Climate TARP functionality to collect the risk value of the different layers for the specific location.

Climate TARP features a forward-looking design that allows customization and upgrading. First, institutions using the app can tailor the financial information requested from the applicant. Second, the app can be updated to ensure that the most recent climatological information is used in the assessment. Further customizations can be made to refine the questions and information collected during site visits to gauge an applicant’s climate preparedness, including the scope for a climatologist or sector specialist to be brought in to improve the criteria and risk indicators utilized.

Climate TARP is currently configured as a climate-smart tool for finance. But the architecture of the software allows for the app to not only analyze climate information, but also assess other geological or health risks and measures of preparedness. Integration with management information systems and core banking systems allows institutions to mainstream these tools and digitize operational processes.

Applying this approach can help unblock the flow of climate finance to ensure that these funds are reaching communities that rely most on a healthy environment, such as those who are producing the food we eat or providing the tourism experiences we are all craving in these pandemic-affected times.